A new enhanced Corporate Income Tax Return with new challenges

A new enhanced Corporate Income Tax Return with new challenges

By James Language, Senior Consultant and Johann Benadé, Associate Director

On 16 September 2024 SARS released an enhanced Corporate Income Tax Return (ITR14) on its website. This new version of the ITR14 must be submitted by all companies with effect from this date.

Amongst a number of changes to the ITR14 is the requirement that all companies are now required to provide detailed information of the individuals that are regarded as their beneficial owners.

Failure to comply with these requirements can result in penalties and compliance notices.

The aim is to enhance transparency and combat money laundering and terrorism financing by ensuring the identity of ultimate beneficial owners is known.

The concept of beneficial ownership has been integrated into the corporate income tax return process to enhance transparency and combat illicit activities such as money laundering and terrorism financing.

The following key points should be noted:

a. Definition - Beneficial ownership in respect of a company means, an individual who, directly or indirectly, ultimately owns that company or exercises effective control over that company.

b. Mandatory Disclosure – As of December 11, 2023, filing beneficial ownership information with the CIPC has become mandatory for companies completing their annual returns. This ensures that the true owners of companies are known, even if ownership is hidden behind layers of other entities.

c. Complex Ownership Structures – The CIPC’s system now accommodates complex ownership structures, allowing companies to report ownership even when the first layer of ownership is another company, a trust, or a nominee shareholder.

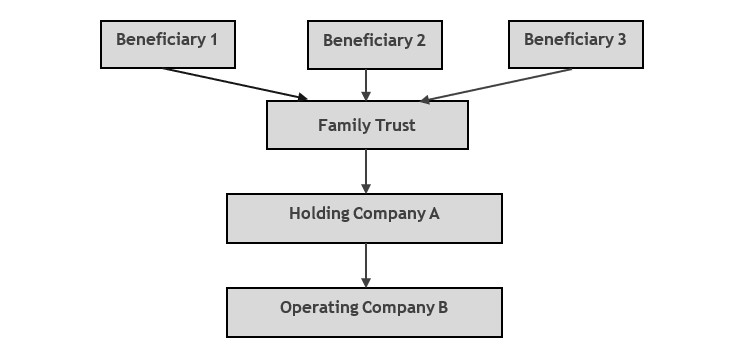

In practice, this could be problematic. Consider the following very common shareholding structure:

If the tax return of Operating Company B is completed, the personal details of Beneficiaries 1 – 3 will have to be supplied, although this might not be readily available.

Previously, SARS only required the details of Company B’s shareholder, namely Holding Company A.

SARS is of the view that beneficial ownership information will help to ensure transparency and accuracy in the reporting of ownership structures within companies. This could prevent potential tax evasion, money laundering and other illicit activities by ensuring that the ownership details are consistent and verified. Detailed share register information could aid in detecting and preventing abusive tax practices or schemes designed to manipulate ownership structures to exploit tax loopholes.

Beneficial ownership information could be used for data matching and verification purposes, allowing SARS to cross-reference the information provided in corporate tax returns with other sources of information to identify discrepancies or potential inaccuracies.

While all of the objectives are reasonable, it is in our view unacceptable that SARS now places a further burden of disclosure on companies for information to which it should be able to access through its on-line interfaces with the CIPC and the various Masters’ offices. Some of the information requested will, however, not be held by CIPC or the Masters’ offices and in many of these cases, it will also not be held by the company.

Completing the beneficial ownership details on the ITR14 can present several challenges. The following considerations should be taken into account:

a. Complex Ownership Structures – Identifying all beneficial owners can be difficult, especially in companies with complex ownership structures. This includes tracking ownership percentages and control mechanisms.

b. Data Accuracy – Ensuring the accuracy of the information reported is crucial. Inaccurate or incomplete data can lead to significant penalties, including fines and imprisonment for wilful violations.

c. Compliance Awareness – Many companies may not be fully aware of the new requirements or the extent of the information needed. This lack of awareness can lead to delays, additional costs and non-compliance.

d. Administrative Burden – The process of gathering and verifying beneficial ownership information can be time-consuming and resource-intensive, particularly for small businesses.

e. Legal and Regulatory Understanding – Companies need to understand the legal definitions and requirements related to beneficial ownership, which can be complex and subject to change.

Some tips to help complete the beneficial ownership details on the new enhanced corporate income tax return:

a. Understanding the Requirements – Familiarise yourself with the legal definitions and requirements for beneficial ownership. This includes knowing who qualifies as a beneficial owner and the specific information that needs to be reported.

b. Gathering Accurate Information – Ensure you have accurate and up-to-date information about all beneficial owners. This includes their full names, identification numbers and the nature and extent of their ownership or control.

c. Use Reliable Sources – Verify the information from reliable sources such as official company records, shareholder agreements and other legal documents.

d. Maintain Records – Keep detailed records of the information you collected and the sources you used. This will help in case of any audits and compliance checks.

e. Consult Professionals – If you are unsure about any aspect of the reporting requirements, consider consulting with legal or tax professionals who specialise in corporate tax compliance.

f. Stay Updated – Regulations can change, so stay informed about any updates or changes to the reporting requirements. Regularly check the CIPC website and other official sources for the latest information.

In conclusion, the new requirements regarding companies’ beneficial ownership are important and care should be taken that the correct information is submitted. However, SARS’ approach in shifting the burden of disclosure of information, much of which should already be accessible to it through the CIPC and the various offices of the Master of the High Court to corporate taxpayers, is in our view unacceptable. The gathering and recording of information to which SARS should be able to access will result in additional unproductive costs for companies that they can ill-afford, given our constrained economic environment.